New small business owners often wonder if they are required to have workers compensation insurance for all their employees. In most cases and states the answer is yes; however, the amount needed can vary, depending on a variety of issues. How much insurance your small business needs can fluctuate depending on what your employees do, how many employees you have and whether they are actual employees or independent contractors.

Do you need workers compensation insurance by law?

This depends on the size of your company and the state in which you are based. In certain states, you may not be required to provide coverage if you meet certain requirements, but most businesses should have some type of workers compensation insurance to save money if there is an emergency. If you and your immediate family members are the only employees of your business, your state might not require you to have workers compensation insurance. However, as soon as you employ non-family workers, you will be required to purchase the coverage.

How much does workers compensation insurance usually cost?

Depending on your location, number of employees and nature of your business, workers compensation insurance prices can range greatly. There are over 600 different “occupational risk codes” that insurers use to help determine the workers compensation premium. Additionally, the amount of coverage and options you prefer can modify your insurance premium. Speak with your independent insurance agent for more details and a free quote.

Why does my company need workers compensation insurance?

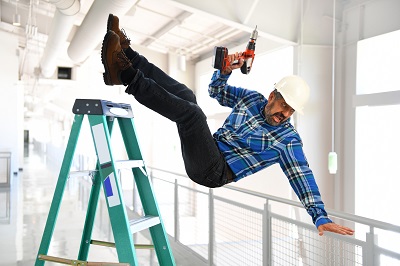

Before workers compensation insurance, if a worker was accidentally injured on the job, they had the option to try to sue the owners on account of their injuries — as well as to cover any medical bills, financial issues and mental hardships. In some cases, if the employee won their lawsuit, it led to overwhelming financial penalties for the company, after which some companies ended up bankrupted. In addition, if the employee did not win their lawsuit, they were stuck with a stack of bills and no way to bring in additional income. Beyond the fact that you are legally responsible for providing workers compensation insurance, it offers businesses and employees alike a safety net in case of emergency.

All businesses, large and small, should have some type of workers compensation insurance. It will save your business if an employee ever has an accident and is injured on the job. Moreover, in most states, law requires it. Even if you do not need insurance just yet, it is a good idea to plan ahead so that you know what to do in the future as your business grows.

Investing in your staff is investing in your business. Call Saratoga Insurance Brokers at 410-781-6396 for more information on business insurance.